For SACCOs & Lenders

Master the chaos of savings and loans with Mobis and grow your client base.

Contact us to learn moreFeatures

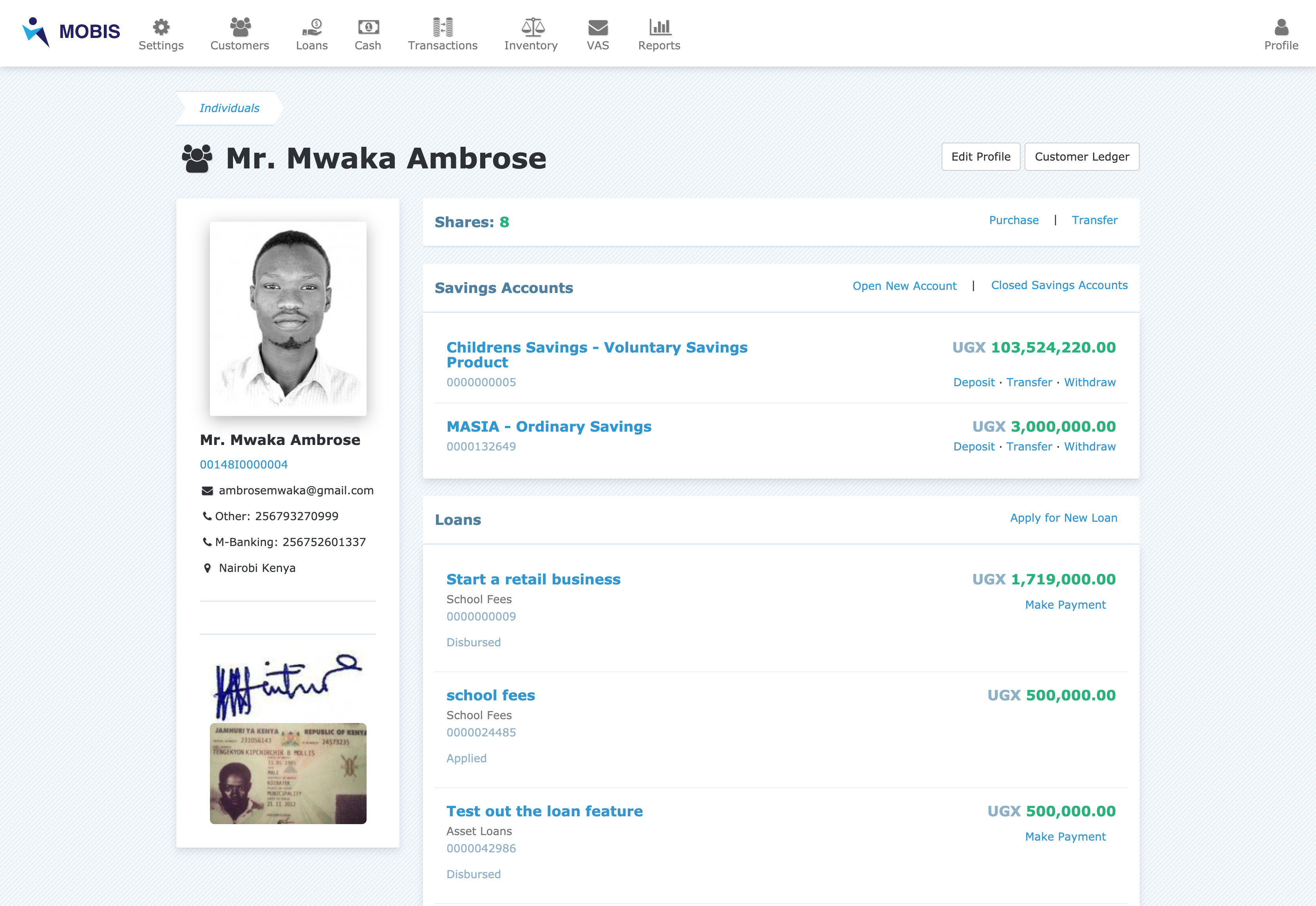

Built as a cloud-based native microfinance management platform, it's uniquely designed to help SACCOs and Lending companies go paperless and become more efficient by digitizing how they manage customer data and transactions.

Cloud based

Access your data, serve your customers at your convinience. You don't need to be at the office to work!

Savings & Loans

Full & flexible loan and savings modules. Launch new products quickly & easily.

Internet & Mobile Banking

Your customers can access their accounts through our internet and mobile banking channels.

Mobile Money

Integration with mobile money and SMS services. Allow your customers to apply for instant loans, view statements, see their balances and receive SMS alerts on transactions.

Bank Integration

We bring the bank to you. Let your customers deposit or withdraw from their accounts through any of our partner banks. Perform automatic bank account reconciliations.

Integrated Accounting

Track expenses, payables, receivables, incomes, inventory easily. Upload bulk schedules and let the software run your accounting for you.

Indviduals & Groups

Track groups and their customers all in one place. Find out more about our app for groups here.

Inter Branching

You can now have better control and visibility over your branches and allow customers to be served at any branch of their choice.

Reports

We give you an extensive catalogue of financial reports with data filtering export features.

User permissions

We let you define what a user can do in the system. Teller? give them only transaction permissions.

Customer support

We give excellent customer support with our teams always on standby to help.

POS integration

We allow you and your customer to deposit/withdraw through POS terminals at their own convenience.

Why Mobis?

Mobis is built as a natural extension of your daily workflow, to automate the most tidious tasks of your daily operations. If its hard to do, chances are we have automated it for you.

Mobis is powered by state of the art security and cloud infrastructures giving you the best

Your data and the data of your customers is our priority. With access controls and fraud detections, you are protected!

Mobis allows your customers to access your services at their own convinience

From MTN mobile money to Airtel, to bank agents withdraws, Mobis has your customers back with our USSD and Mobile App.

Here is what our customers think

Used by over 100 SACCOs and lending companies.

Here’s a few you may recognize.

If all this sounds good to you, contact us now

We shall arange for a demo to show you so much more about Mobis

Request a demo

Frequently asked questions

Below you will find answers to the questions we get asked the most about Mobis our platform for SACCOs and Lenders