Dominant Fintech Partner for Community Finance in Africa.

Ensibuuko powers digital banking and lending for savings groups, SACCOS, and Micro-Lenders, enabling bank-led embedded lending partnerships that expand financial access for unbanked communities across Africa.

One Platform. Infinite Reach. Real Impact.

Our infrastructure powers every model of community finance — from grassroots savings groups to national SACCO networks. This is how you build financial inclusion at scale.

SACCOs — 97+ cooperatives

The Digital Backbone for Member-Owned Banking

Savings and Credit Cooperative Societies (SACCOs) are Africa's original fintech — democratic, member-owned institutions that mobilize savings and offer credit. We've digitized this model for the 21st century.

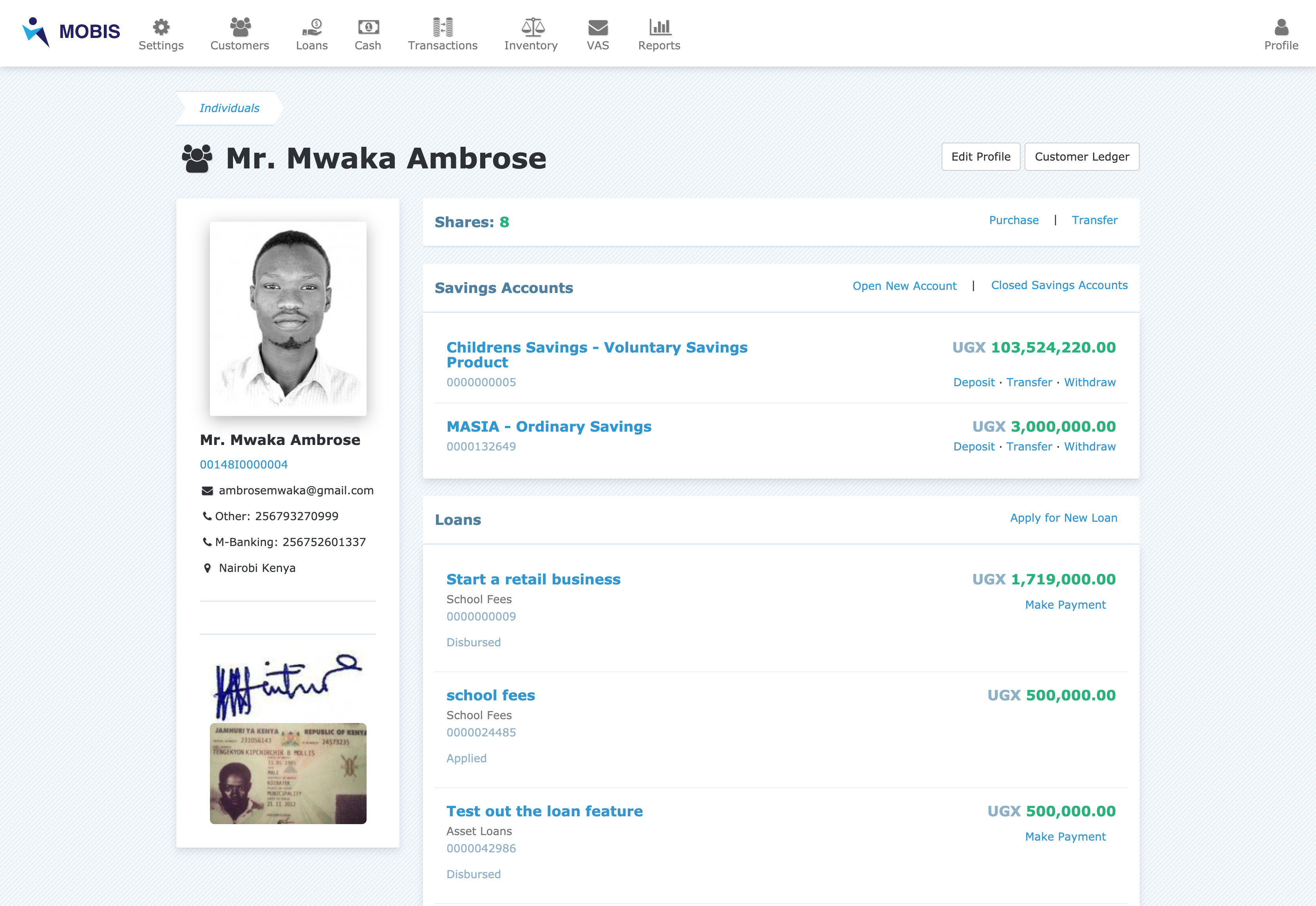

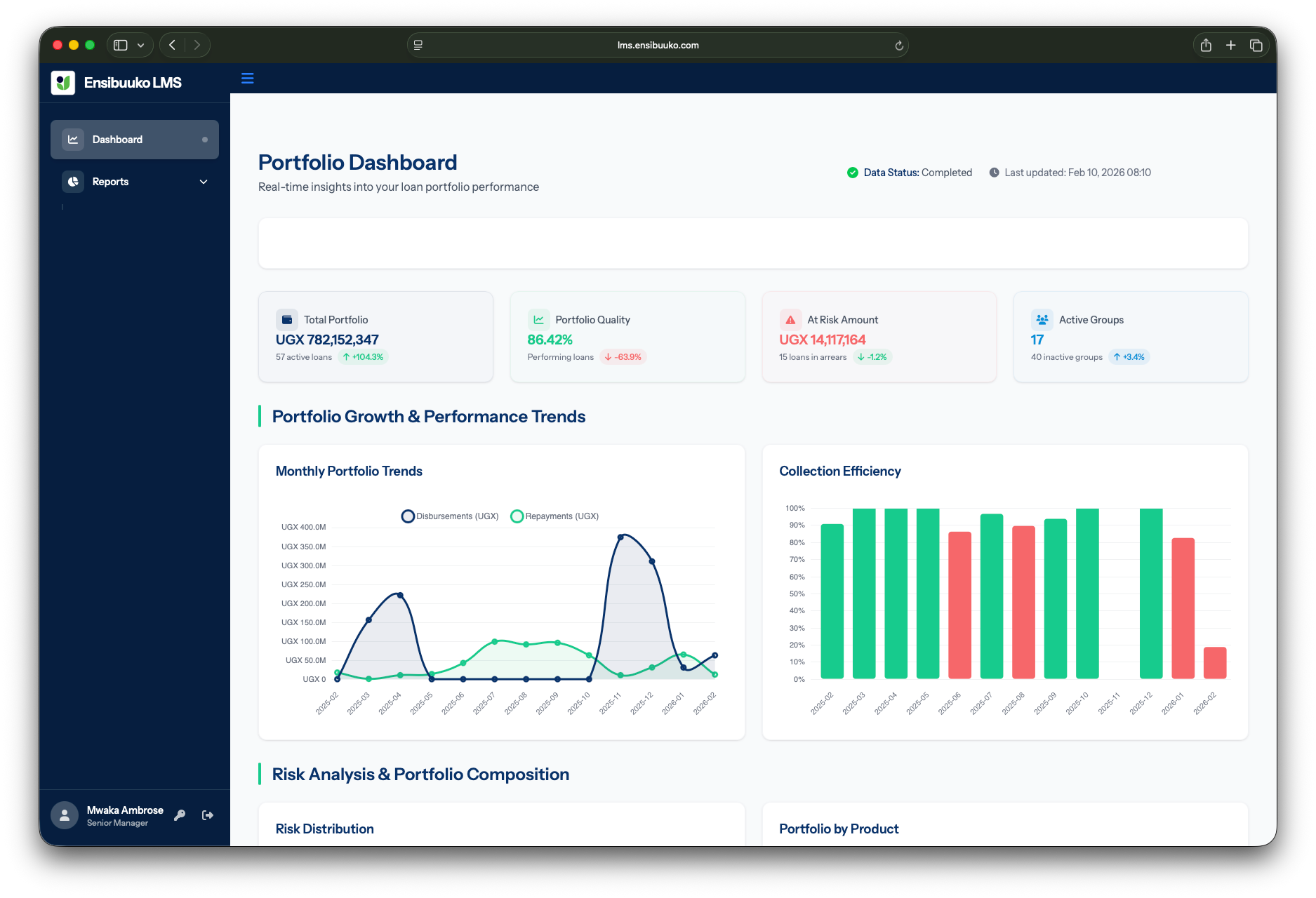

MFI, and Money Lenders — 100K+ Active Customers

Digital Credit Infrastructure That Scales

Microfinance institutions and lending companies need technology that can handle millions of transactions, complex loan products, and rapid growth. That's exactly what we've built.

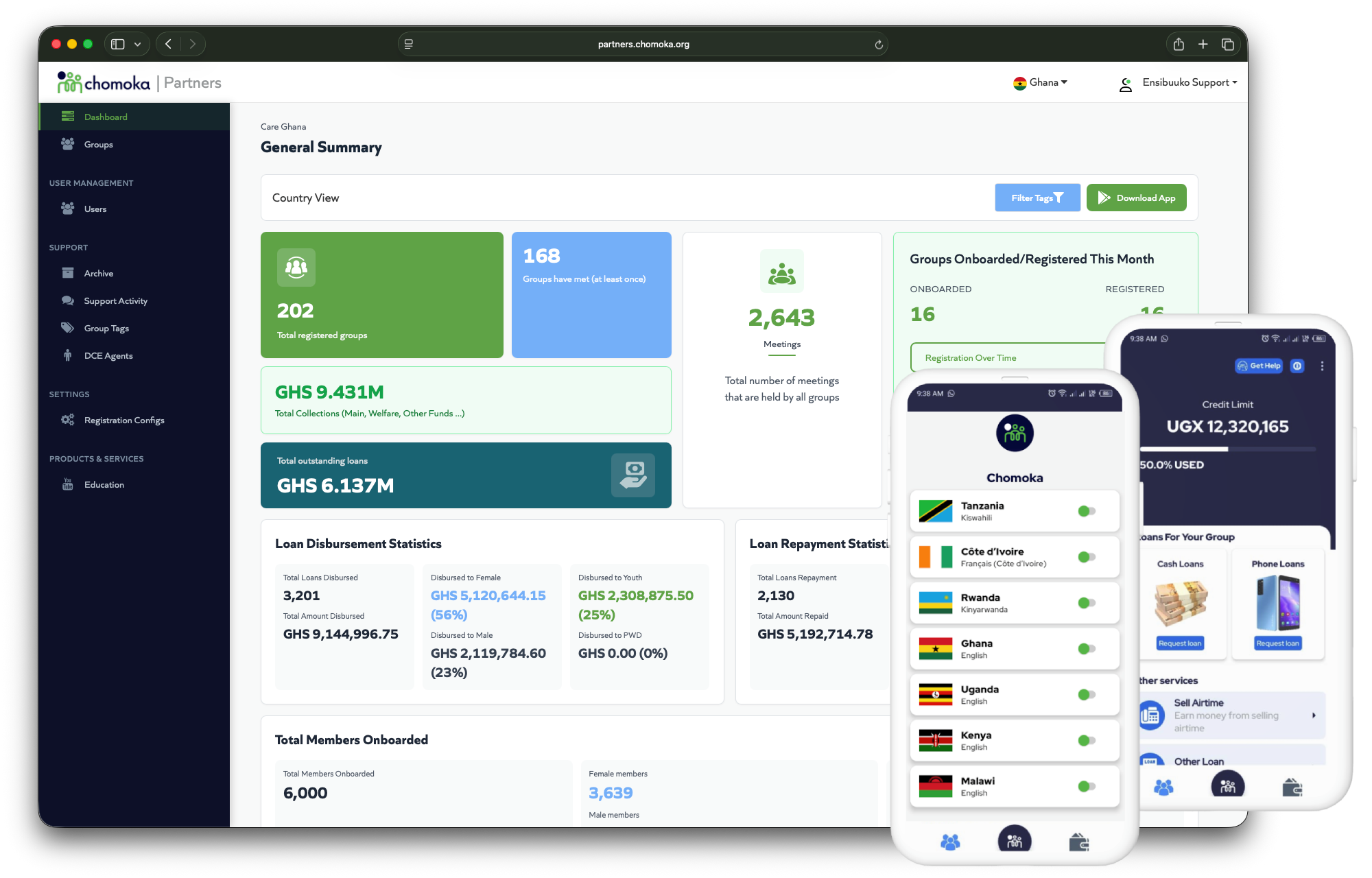

VSLAs — 20K+ Groups

Where Financial Inclusion Starts: The Grassroots

Village Savings and Loans Associations (VSLAs) are where most Africans first experience banking. We've digitized the model — bringing security, transparency, and mobile access to the last mile.

The Infrastructure Play

We're not just another fintech — we're building the financial infrastructure for Africa's underserved markets. Here's why this is a generational investment opportunity.

Market Leader

Dominant position in community banking across 6 African markets

Proven Unit Economics

780M+ in loans with strong repayment rates through community trust

Network Effects

Each new institution strengthens the platform — classic infrastructure play

Massive TAM

400M+ unbanked in Sub-Saharan Africa — we're just getting started

Real Change at Scale

Working with development organizations, NGOs, and foundations to deliver measurable financial inclusion impact across Africa's most underserved communities.

Financial Inclusion Infrastructure

Built the rails that connect communities to the formal economy

Refugee & Rural Communities

Banking for displaced populations and remote villages across 145 districts

Economic Empowerment

Brought communities into the money economy with digital credit and savings

Measurable Impact

Track every dollar, every loan, every life changed — transparency built-in

Digital Lending Infrastructure

Partner with us to extend digital credit to underserved communities through our proven infrastructure. White-label our platform or integrate via API to reach millions of creditworthy Africans.

Ready Distribution Network

250K+ SACCOs and Micro Lenders already using our platform across 6 countries

De-risked Lending Model

98% repayment rate through community-based credit scoring and peer accountability

Rapid Integration

RESTful APIs, webhook support, sandbox environment — go live in weeks not months

The Numbers Don't Lie: This Is Scale

From refugee camps to national SACCO networks — we've built the infrastructure that actually works.

Real Financial Inclusion Metrics

This is what happens when you build infrastructure that actually works

From Bank and Embedded Lending Partners.

Community-based lending model that works

Economic empowerment for female entrepreneurs

Six Countries. One Platform. Infinite Potential.

We've proven the model in East Africa. Now we're scaling across the continent — bringing the same infrastructure to every community that needs it.

Uganda

Uganda

Tanzania

Tanzania

Malawi

Malawi

Nigeria

Nigeria

Ivory

Coast

Ivory

Coast

Ghana

Ghana

This Is Just The Beginning

We've proven it works - 21,000 institutions, 1 million lives, 780 million in loans. Now we scale.

The vision: 5 million Africans with access to digital credit and banking by 2028. The infrastructure to make it happen: already built and tested.

Technology Built to Scale

Cloud-native infrastructure that handles millions of transactions daily

Distribution Model Proven

Partner with existing community structures — they trust us because we work

Unit Economics That Work

Sustainable model that serves the bottom of the pyramid profitably

Why We're Different: We Actually Solved It

Everyone talks about financial inclusion. We built the infrastructure that actually delivers it — 1 million accounts, 780 million in loans, 6 countries. This isn't a pilot project. This is proven scale.

Battle-Tested at Scale

Not a prototype — handling millions of real transactions daily across 6 countries

Built for Africa's Reality

Works offline, on feature phones, in refugee camps — designed for the last mile

The Network Effect Is Real

21K institutions on one platform — each one makes the network more valuable

Measurable Impact + Profitable

Sustainable unit economics serving the bottom of the pyramid — not charity, capitalism

Who works with us

We are backed by leading investors and partners to deliver our promise on financial inclusion in Africa.

Investors

Banks

Fintechs

Development Organisations

Stories from our community

"We processed over $12 million in loans last year through Ensibuuko. The platform handles our entire network of 85 branches — reconciliation that used to take weeks now happens in real-time."

"We work with refugee settlements in Northern Uganda. Ensibuuko gave these communities their first access to digital banking — people who had nothing now have savings accounts and access to credit."

"Our women's savings group went from 20 members meeting under a tree to 150 members managing everything digitally. We've disbursed over $50,000 in loans — all tracked, all transparent."