Embedded Lending Partner for Inclusive Banks

We connect inclusive banks to a verified pipeline of SACCOs, savings groups, and bankable individuals, supported by digital infrastructure for safe underwriting, disbursement, and repayment at scale. Partner with us to deploy capital through a proven lending model.

Thousands of SACCOs and savings groups pre-vetted on governance, repayment history, and digital readiness.

Group portfolios with transparent audit trails and automated reminders keep PAR low.

We connect formal capital to last-mile borrowers through mobile money, agents, and bank rails.

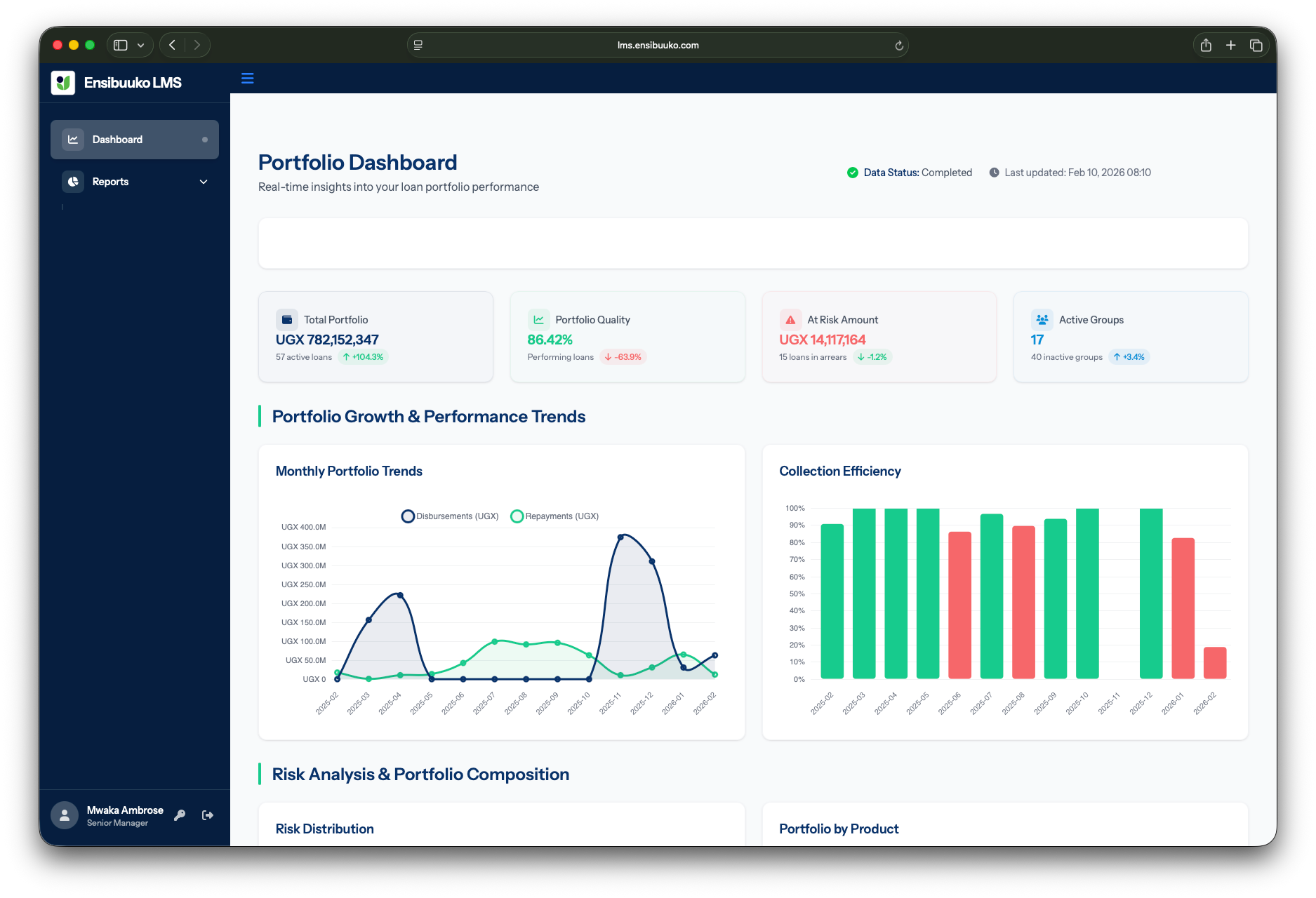

A live lending engine, not a pilot.

We operate proven rails—from KYC to repayments—with real transaction volume. You bring capital; we handle origination, servicing, and transparent reporting.

Rails for underwriting, disbursement, and collections.

Bank-grade controls with last-mile usability: branch teams, agents, and borrowers stay in sync across web, Android, and USSD.

KYC + onboarding

Member and group profiles, KYC capture, signatories, and guarantees validated before origination.

Decisioning + offers

Automated scoring signals from savings, attendance, and repayment data; product templates with rate and tenor controls.

Disbursement + controls

Payouts via mobile money, agents, and bank rails with dual approvals, limits, and instant receipts.

Servicing + collections

Automated schedules, reminders, exception flags, and agent-assisted collections keep PAR in check.

Ledger + reporting

Regulator-ready exports, reconciliations, and audit trails for partners and funders.

Risk + compliance

Role-based access, maker-checker controls, and audit logs aligned with partner policies.

Plug capital into a ready engine.

We pair your balance sheet with our distribution, data, and servicing to deliver safe, scalable credit to underserved customers.

Define products

Set limits, rates, tenors, and risk policies; map to mobile money or bank rails.

Activate pipeline

We activate vetted SACCOs, groups, and individuals; collect KYC and onboarding data.

Disburse and monitor

We run disbursements, collections, and exception management with transparent reporting.